Pakistan has been a latecomer to the startup scene but the 2021 Pakistan Startup Ecosystem Report [PSER 2021] documents remarkable growth in the sector despite the Covid-19 pandemic. In terms of funding, Pakistani startups hit an all-time high at $350 million, which was more than five times the $65 million that was raised in 2020. The latest figures indicate a continuation in the growth pattern from 2021, as till March of this year the sector has already raised $163 million.

Pakistan has been one of those untapped startup markets that has a lot to offer with its youth potential, increased cellular connectivity and availability of affordable data along with plenty of local tech talent and a returning diaspora bringing business and tech acumen. And the pandemic has been a decisive moment for this substantial growth which allowed emerging entrepreneurs to create digital products with meaningful human impact.

Services in this sector range from e-commerce avenues, food and grocery delivery, to ride-hailing and financial services, including names such as Tazah, Qisstpay, Bazaar, Tajir and Airlift. However, major startup trends – much in the aftermath of the pandemic – focus considerably on agritech, fin-tech and grocer applications.

Nevertheless, in order to exploit further opportunities, the sector has to offer a supportive infrastructure that will not only sustain the current growth but will also protect the startup biome and allow it to flourish. For this, not just the government but the startups themselves need to adapt and understand the dynamics of the ecosystem in which they operate – including importantly the role of family-owned businesses as well as the expectations of international institutional VC and PE investors.

And the foundations have already been set. These range from policy reforms including a comprehensive legal framework for Electronic Money Institutions set up by the State Bank of Pakistan to a viable Digital Banking Policy as well as the establishment of Special Technology Zones, among many other infrastructural arrangements.

Where on one hand it is encouraging to see how the startup culture in Pakistan is booming at an exciting rate, on the other, one must acknowledge the many gaping challenges that remain. There are some prominent technical and psycho-social issues, the lack of understanding of which constrains a major growth breakthrough.

It’s crucial to see:

Understanding the significance of accounting as a necessity in the startup culture can help emerging entrepreneurs evaluate financial dynamics of businesses by conducting monetary evaluations and keeping oversight. This is unfortunately lacking in the Pakistani startup consciousness.

Whether they’re preparing for funding rounds or exit scenarios, startups have to undergo the due diligence process. And because startups depend on raising venture capital to succeed, investing in an accounting function is crucial for them from early on.

A direct corollary of the above point pertains to the importance of a specialized finance business partner.

Finance Business Partners bring more alignment and cooperation among key business functions. They act as strategic partners to the business to drive sustainable growth at the right level of profitability. Our work at Trivium Global has yielded this insight through direct exposure to this type of challenge at multiple startups.

After all, given the dynamic nature of the startup environment, having professional financial oversight is only pragmatic.

Tracking the right data at the right time is significant. Every startup is different and therefore, has individual metrics which need to be gauged.

GMV (Gross Merchandise Value), for example, is a good indicator of growth for e-commerce businesses and while it’s useful as a comparative measure overtime, it doesn’t give the full picture of a company’s performance.

Investors now prefer looking at metrics like profitability and net revenue because the health of a business cannot be judged by its GMV alone. To get the full picture, it should be tracked in combination with other crucial metrics.

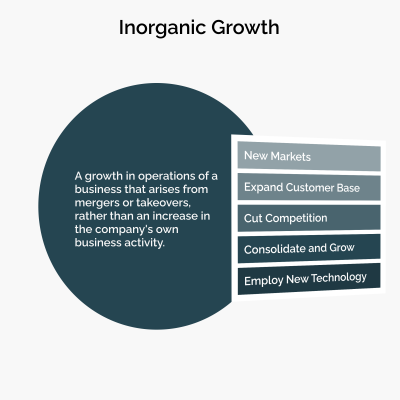

Firms can choose to grow inorganically in several ways, including engaging in mergers and acquisitions, instead of relying solely on increasing their own business activity, and in the case of retail, opening new branches.

With the right corporate development strategy, mergers and acquisitions can help companies grow more synergistically and get faster access to new markets.

To really harness their competitive advantage, Pakistani startups can begin by increasing their focus on corporate development and inorganic growth.

Startup funding is a major issue that can determine the path a startup may take. In this regard, VCs and other funding agencies play a critical role.

With the government providing small and easy loans to families under their flagship programs and the State Bank overseeing mechanisms to improve availability of funds, there are only 3 major investors who have been able to acquire the SECP’s PE and VC License – namely Lakson Investment Venture Capital, JS Investments Limited and PNO Capital Limited – that provide funding to startups even though the regulatory environment is quite unfriendly.

However, there are other active investors as well which include Ratio Ventures, Globivest and Afropreneur Syndicate, among others.

Tiger Global recently led a $2.1m pre-seed investment round in a Pakistani B2B startup (Zaraye) for the first time.

The startup ecosystem in Pakistan started to develop a few years ago observing some growth in 2012 but 2021 really became a critical juncture for the startup industry in the country. With optimal planning and strategy planning Pakistan can capitalize on this emerging sector to treat its economic ails and seek for itself a future in an increasingly digital economy.