Most firms suffer during periods of economic decline – including startups. However, the changing conditions during recessions often present opportunities for smaller, more resourceful firms to outmaneuver larger competitors, who are either engaged in routine business practices or are unable to adapt quickly (except to downsize). That means your startup has an inherent advantage.

Successfully Navigating Turbulent Waters

A study profiled in HBR on the recessions of 1980, 1990, and 2000, showed that 17% of the 4,700 public companies it studied fared particularly badly. They either went bankrupt, private or were acquired. The surprising part however was that 9% of the companies didn’t just recover in the 3 years post-recession, they flourished. These companies were able to outperform competitors by at least 10% in both sales and profit growth.

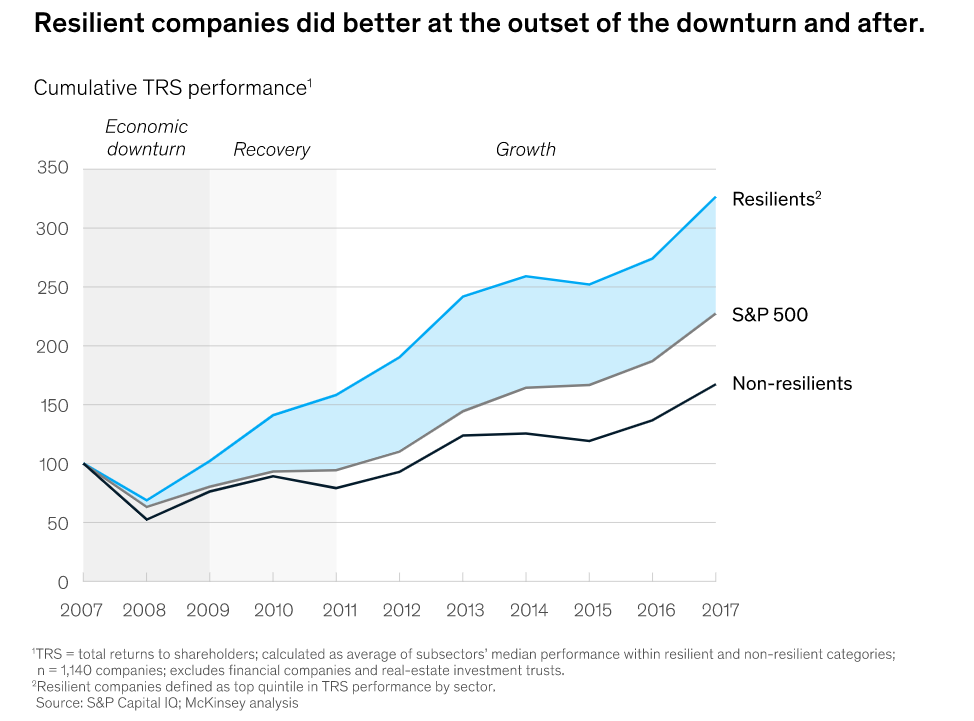

A more recent analysis by Bain using data from the Great Recession during the late 2000s reinforced that finding. The top 10% of companies in Bain’s analysis saw their earnings climb steadily throughout the period and continue to rise afterward. A third study, by McKinsey, also found similar results.

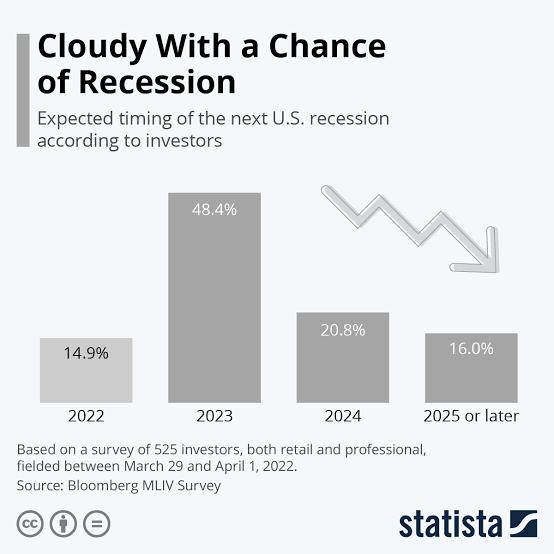

Predicting a recession is difficult. However, preparing in advance and aligning on strategy prior to a downturn are key to help companies survive when recessions do hit and also come out on top in the years that follow.

How to Position Your Company for Success in a Recession

Recessions are known to “shuffle the deck” a lot more than times of economic boom.

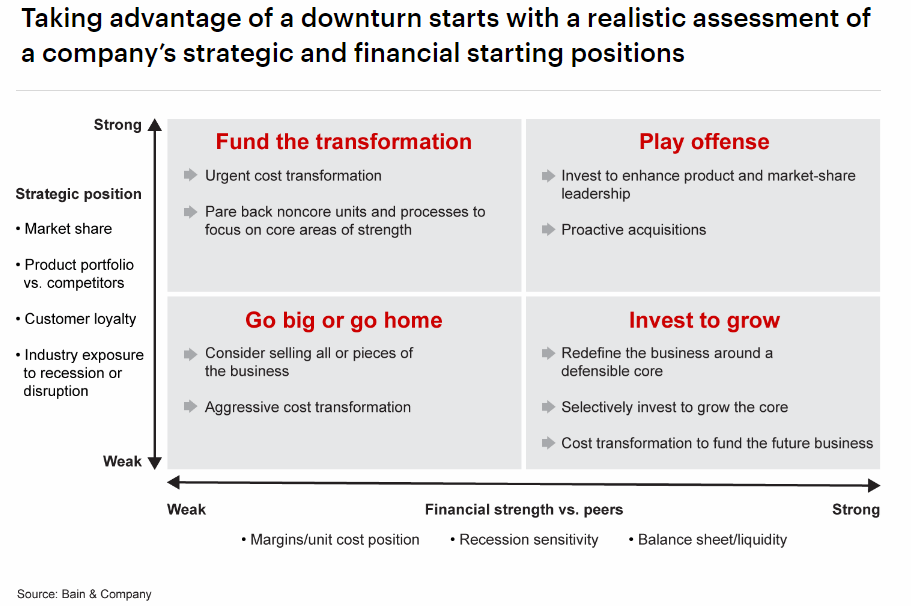

Playing offense by reinvesting strategically for commercial growth helps companies come out of recessions stronger than those that are focused on survival.

Established companies with lower levels of debt find themselves in a unique position in times of crisis – they tend to be positioned optimally to use M&A to buy new product lines, customer segments or capabilities at lower prices in times of downturns. Recognizing these opportunities by planning investments proactively allows companies to avoid paying a higher price later when interest rates rise.

Startups can begin by looking into alternative funding options or consider pivoting their businesses.

Here are some key ways you can set your company up for success during and after a recession:

Restructure Costs Prior to the Recession

Because periods of recession usually bring lower sales and therefore less cash to fund operations, it takes clever financial management to survive a downturn. Studies show that companies with higher levels of debt are particularly vulnerable during a recession.

Companies that don’t deleverage before a downturn essentially limit their options and sometimes the only way they can keep their operations going is by cutting costs through layoffs.

These cost-cutting measures lower their productivity and also affect their ability to act opportunistically.

However in reality, many companies have some level of debt going into a recession. While having moderate levels of debt is not a problem, it’s wise to start deleveraging even before any clear signs of a recession appear. This way, your company can focus on opportunities for growth rather than being stuck on survival mode when the recession hits.

Opt For Decentralized Decision Making

Firms where decision making is centralized may be expected to fare better because of access to overall company information, and incentives being closely linked with company performance. Yet, in an economic downturn, the value of local information increases, hence, decentralized decision-making can help your company weather economic shocks better.

Research shows that decentralization has been associated with relatively better performance for firms during a financial crisis. This study also found that as conditions improved, the benefits of decentralization decreased, which points to the fact that delegation is particularly useful during times of uncertainty.

Because decentralized firms delegate decision making further down the hierarchy, they are able to adapt better to changing conditions. This can be crucial for the survival and success of your company.

Master Workforce Management

Layoffs aren’t just harmful to workers, they’re costly for companies too. Hiring and training people is expensive, particularly when the whole process has to be repeated because the downturn is expected to be brief. Layoffs also hurt team morale and reduce productivity at a time when the company really needs it.

Fortunately, there are other ways to cut labor costs. Companies that opt for hour reductions and furloughs can survive the recession without downsizing and not have to engage in the hiring process all over again when the economy picks back up.

In an effort to align worker incentives with changing conditions, companies can also rely on performance pay more frequently during economic downturns.

Adopt a Digital Transformation

Technology makes your business more transparent, flexible, and efficient. Prioritizing a digital transformation ahead of, or even during, a downturn can benefit your company in several ways. One way is through improved analytics – this can help management understand the business better and how the recession is affecting it. It can also help find room for operational improvements.

Another reason is that the adoption of digital technology can help cut costs. Companies can prioritize task automation and adoption of data-driven decision making in an effort to eliminate costs related to transformation projects that have a quick pay off .

Additionally, investments in IT make companies more agile and therefore better able to handle the uncertainty and rapid change that comes with a recession.

Wrapping Up

Most companies don’t make it out of recessions in one piece but that does not mean it isn’t possible. Agile companies will always be better prepared to deal with uncertainty than organizations that do not “get with the times”.

Leaders should be ready to innovate and take advantage of the unique opportunities that arise during economic downturns to make their organizations more resilient in the face of such crises.