Importance of Cloud FP&A

Using spreadsheets for budgeting, planning, and forecasting makes these processes harder than they should be, moreso in growing businesses. Not only are spreadsheets more time-consuming, using them also increases the frequency of errors. One of the biggest benefits of cloud-based FP&A solutions is that they completely eliminate dependence on spreadsheets.

A report by Aberdeen Research found that companies using cloud-based FP&A are more likely to achieve higher gains than those using on-premises applications. Cloud solutions are great because they provide unique benefits above and beyond what is already being provided by on-premises solutions.

To support a firm’s major business decisions and overall financial health, finance professionals need to be able to combine financial, operational, and external data in one place.

The only way to do that is with the Cloud.

How Cloud FP&A Transforms Your Business

Scalability

Owing to their size and structural limitations, spreadsheets are no longer considered to be the most adequate tool when working with large stores of data. In the past, multiple organizations have had their data skewed by MS Excel and suffered very publicly from it.

Growth-centric and agile organizations can derive great benefit from more advanced and refined solutions like Cloud FP&A.

Cloud-based FP&A platforms enable growth because they are great automating and unifying tools. They can easily handle and organize large amounts of data, requiring minimal input from a human being. This way, companies can expand while knowing that their data is workable and secure.

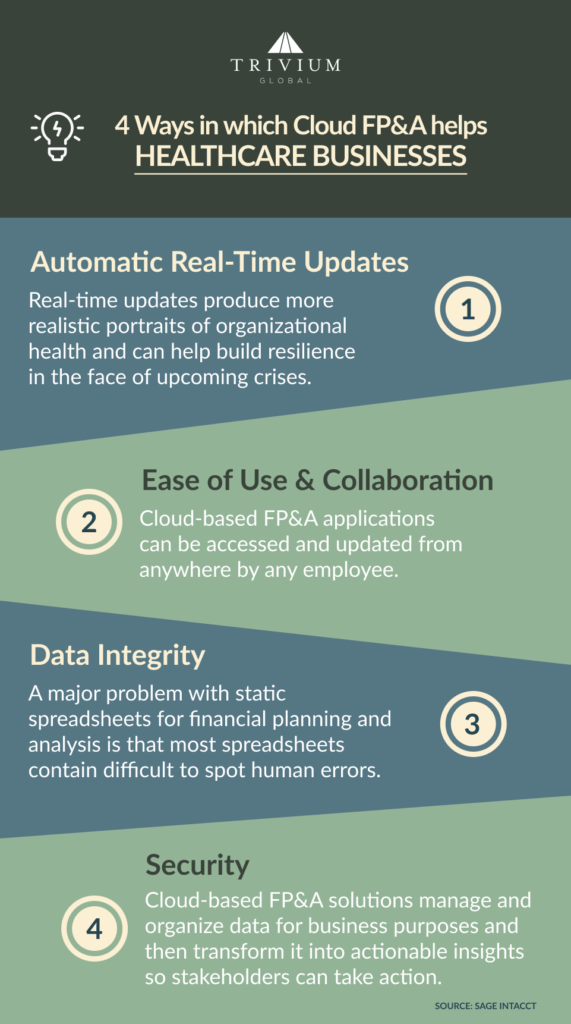

Data Integrity

Time-consuming FP&A processes such as consolidation and close are used for the adjustment of potentially inconsistent data sources. Having a single database that serves as the principal source will give the entire organization access to the most current data so that any planning and forecasting remains updated across the company.

Real-time insights

Because the market evolves at an accelerated pace, businesses that struggle to understand what different departments under them are doing tend to hinder their growth. When companies use platforms that evolve as quickly as the demands on their business do, they become more dynamic.

Thus, cloud FP&A solutions give you real-time insights into your most important metrics and KPIs.

Company-wide Collaboration across departments

Company-wide collaboration tools can increase accountability and reduce the number of communication channels.

Instant access to relevant data is of the utmost importance in the planning and forecasting process because, without it, plans and forecasts run the risk of becoming irrelevant. Improved communication and collaboration are critical because different business lines often have different views – and these can only be reconciled through improved collaboration.

Lower costs

Cloud applications usually have subscription-based pricing models instead of upfront capital expenditures and pricey software licenses. As a result, small businesses find it easier to adopt. It also makes the process of scaling the number of users up and down much simpler as the business matures. Having one platform for both planning and business intelligence also cuts down on extra costs.

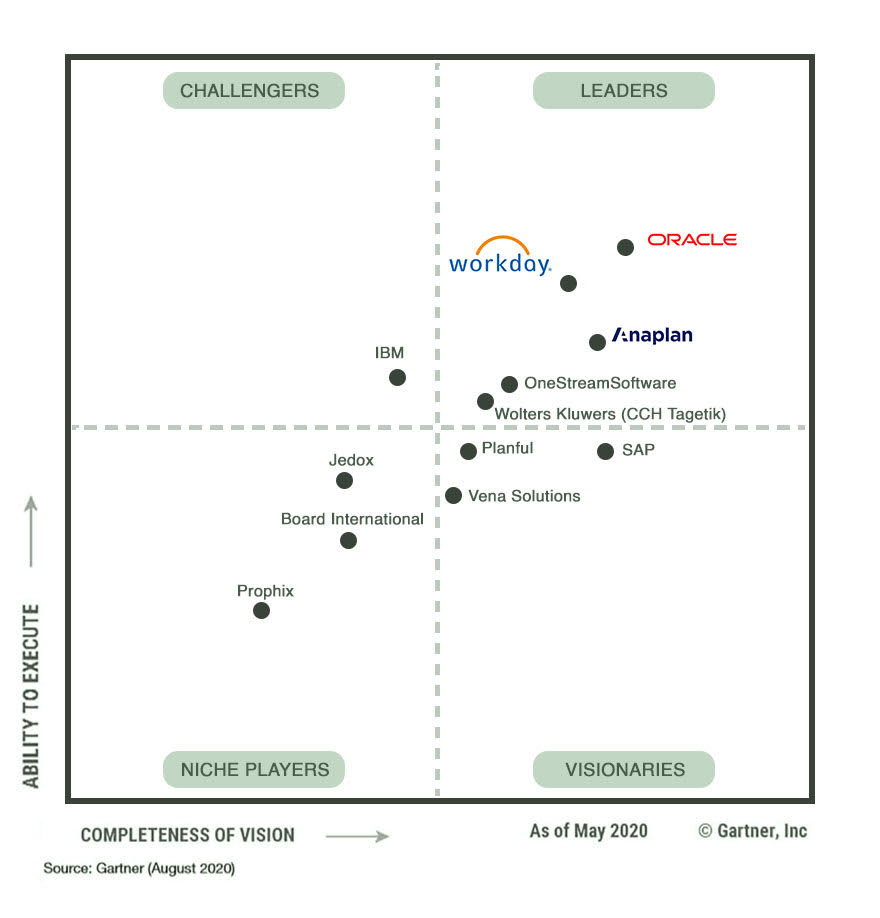

Top companies that provide FP&A software

Anaplan

Both powerful and flexible, Anaplan is a great software for large enterprise customers that are backed by strong IT teams, capable of leading enterprise-wide transformation initiatives.

Anaplan targets bigger organizations and is suited to big FP&A teams, but it also requires more IT support.

Workday

Workday’s value proposition is its strong capabilities outside of Finance and FP&A. Their solutions also cover financial, sales, and workforce planning. Workday provides FP&A for large companies and powerful modeling for businesses of all sizes. It works seamlessly with cloud-based, file-based, and on-premise applications.

Oracle (NetSuite)

Organizations that have NetSuite solutions already deployed in different areas of their business are the ones that can benefit most from this particular software. It automates laborious processes and centralizes all company data.

Barriers to Cloud FP&A Adoption

To stay agile, organizations need to prepare for the future and adopt new technologies. But doing that can be a challenge. As technology advances, so do regulatory requirements and uncertainties. That also means more compliance and more cost.

Large corporations tend to have multiple finance teams and fragmented regulatory bodies, due to which the process of getting reviews and approvals becomes prolonged.

The pace of adoption is also affected by cultural challenges such as a lack of clarity about what cloud implementation will mean for the workforce. Failure to grasp the importance of such a platform can cause resistance to change.

Cloud adoption requires a company-wide mindset shift because it’s not just an IT transformation, it’s an organizational transformation. But due to the time it takes to implement it, particularly in larger organizations, some CFOs have reported a ”lagging ROI”.

Best Practices to Implement Cloud FP&A Solutions Within Your Organization:

- Cloud FP&A providers should provide better training/deployment/onboarding to enable learnings so finance and FP&A staff can extract value out of the solutions.

- Each finance group within a company needs to define its Cloud FP&A tool use case – i.e. using a drivers-based approach or direct input, but the idea is to use the Cloud FP&A tool as the core model that drives forecasting, budgeting, and planning.

- Companies need to develop power users to drive adoption and business transformation within the organization. Power users are critical for cultural and technical influence to drive adoption.

- Companies need to establish multiple stop gaps during the change management process to maintain data integrity so the business can still report on earnings, which obviously impacts street guidance and financial disclosure/reporting requirements.

Wrapping Up

In conclusion, organizations that adopt cloud-based solutions for financial planning & analysis are likely to achieve significant business benefits over those with on-premises solutions

benefits like advanced functionality, quick implementation, and more efficient processes, only for a fraction of the cost.

If Cloud FP&A sounds like something your business could benefit from, get in touch with us.