Price increases may be inevitable in times of economic hardship, but this doesn’t mean companies don’t have other options. Instead of focusing entirely on cost changes, businesses would fare far better during and after inflationary cycles if they attempted to determine what drives the most value for their customers.

To be able to do this well, good analytics and operational visibility are key.

Identifying Areas of Improvement

Hard times can force companies to recalibrate and address their inefficiencies and potentially eliminate them. If redundant processes that eat away at profits are redesigned to work better for your company, you won’t always have to resort to raising prices during times of inflation. Instead, eliminating the extra cost on your side will help absorb the unavoidable costs brought about by the economic climate. You can achieve this by collecting and understanding the right data.

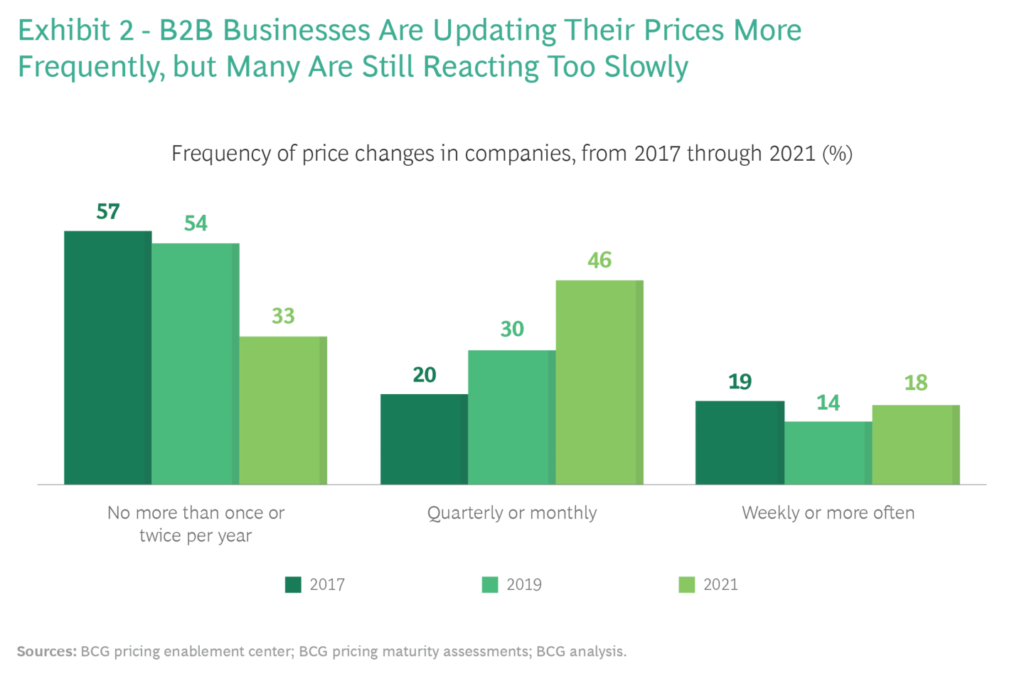

Reporting data weekly and doing the necessary analytics to understand where an increase in price makes sense is essential not only to survive these periods but also for long-term customer retention. If customers see that you’re not increasing prices like many, or most, of your competitors, this will bode well in the long-term.

Even during periods of inflation, customers have some power so it’s important to understand what changes the current market conditions will support and make decisions based on that.

Being Agile in Decision Making

In such times, the pace of decision-making has to be increased profoundly. Since businesses are operating in an “abnormal” environment, they have to keep close track of, and assess, every change that is made and be quick to make adjustments. This is where operational visibility and speed of evaluation and appropriate action become crucial.

For example, retailers can incentivize their customers by developing more standardized options while manufacturing companies that can streamline their processes and provide the same level of quality without increasing prices can set up a win-win. It boosts productivity while maintaining margins and customers don’t even have to pay a higher price.

Having a team of dedicated cross-functional decision makers who can make well-informed decisions promptly and gauge feedback in real time when adjusting prices is what sets agile companies apart from others.

Growth-centric and agile companies often encourage their teams to anticipate what products in their portfolio are most likely to get affected by price changes in times of economic turmoil. Preparing for inflation proactively by rethinking elements of product design, like features, materials and packaging, while still preserving value for customers, allows businesses to maintain some control over costs during times of uncertainty. This means they start developing modified products early on, in an effort to lower costs associated with production and service before the cycle begins.

However, modifying products isn’t the only way for companies to be proactive. There are other ways by which they can reduce costs ahead of time, like automation, reducing inventory, choosing the right vendors, and opting to bundle or unbundle certain products to increase value to customers and maximize margins. If you’re thinking – “Well that would require investment.” Then yes, in such times you may want to consider making investments to make improvements across your business to build its resilience and address latent risks.

Can Price Increases Hurt Businesses?

A flat approach to increasing prices may work in the short-term, but it’s not a good long-term strategy. It reduces customer loyalty and pushes people to seek alternatives elsewhere. This is why a more thoughtful approach is bound to work best – one where each customer and product segment is evaluated based on analytics and price increases are tailored accordingly.

Raising prices can also lead to unintended outcomes that may not work in the company’s favor once the cycle ends.

To optimize their pricing strategies, companies should consider competitors’ moves, customers’ willingness to pay, and other dynamic variables that are subject to changes in price. They should also anticipate the level of margins they hope to achieve from the price change by linking key indicators with analytical models.

The Way Forward

Periods of inflation come with a whole set of financial challenges but they also present many opportunities for business leaders, like getting the chance to reexamine your business and fix any “leaky buckets”, thereby maintaining margins and avoiding unnecessary price changes.

Another would be the opportunity to streamline your company’s internal processes to allow for timely and knowledgeable pricing and use that to drive future growth and tackle inflationary cycles proactively.