The juxtaposition of Artificial Intelligence and Finance and Accounting has played a pivotal role in the sector’s digital transformation. AI has not only taken over repetitive bookkeeping tasks but has also delivered forward-looking insights to drive strategic decision-making. Machine learning models applied to data help in reducing fraud, data errors and enhance trust. While AI does reduce the need for human intervention, it doesn’t necessarily steal jobs. On the contrary, AI helps Finance and Accounting professionals perform their tasks more efficiently by saving time and increasing accuracy.

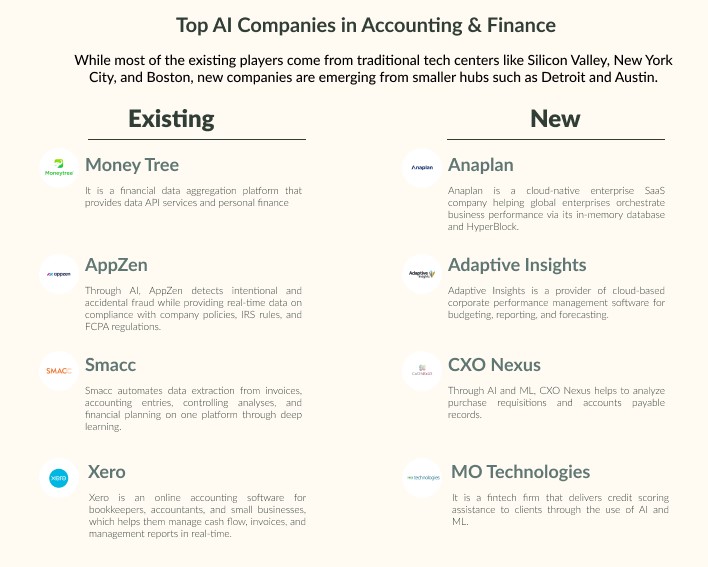

The growth of new companies accompanies technological innovation in the field of AI. Thus, the competitive economic environment has enabled the rapid adoption of AI by Finance and Accounting firms.

Here’s a quick look at how AI-automated accounting systems increase efficiency while minimizing costs.

You’re probably already familiar with Enterprise Resource Planning (ERP) software as it has become an inevitable part of small to large organizations. It consists of tools to facilitate the management of all information that impacts a company’s business decisions. ERPs help centralize and optimize operations with connectivity while reducing manual labor.

Through ERPs, companies can integrate multiple processes and hence accurately define a budget and allocate costs. They can help manage cost analysis, profit tracking, invoice tracking, budgeting, and investments because of the increased tracking capabilities. Additionally, the data is highly secured within an ERP, and it provides an in-depth analysis when required.

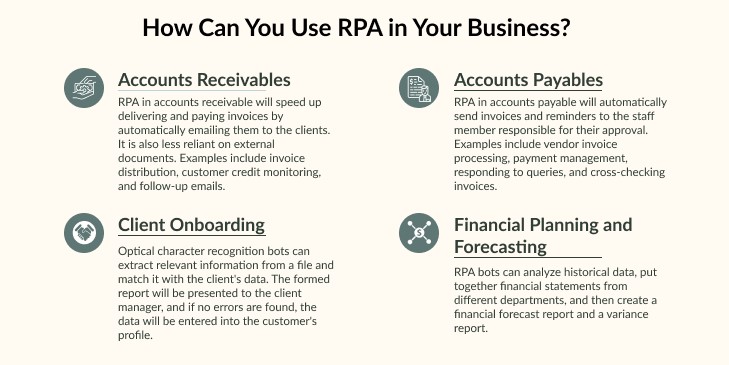

Robotic Process Automation (RPA) is the use of automation applications, such as UiPath and Blue Prism, to reduce the level of human labor needed for Finance and Accounting transactions.

RPA delivers multiple benefits to those in Finance and Accounting to evolve and act following the variables that dictate the financial sphere. Some of these benefits include scalability, efficiency, data innovation, and customizable workflows. RPA can help reduce data transcribing tasks by 80% in accounts payable, financial closes, and tax accounting.

Now let’s have a look at how AI is transforming Finance and Accounting.

The ability to learn from past data makes AI an asset in the financial services industry. Since AI is data-driven and data-dependent, it eliminates the need for physical bookkeeping – a quick scan gives AI the ability to make a recommendation of loan and credit offerings.

AI uses past spending behaviors on multiple transactions to highlight any odd behavior. Moreover, the system adapts to changes quickly, increasing accuracy.

AI has been established as a competent decision-maker in financial advisory services. A combination between machine calculations and human insights provides a much more efficient insight.

Trading and predictability go hand in hand. Machines can observe patterns in the past and predict future outcomes, therefore AI can be used for future forecasting. The algorithm can be altered to give suggestions according to the person’s risk appetite.

AI can help users manage their finances by helping them make smart decisions about their money when they are spending it. It does this by collecting data from the users’ web footprint and creating a spending graph.

AI in finance is amongst the few technologies that are paying dividends. Artificial Intelligence has transformed the banking and finance industry and has made it more demand-specific. Accessing, spending, and saving money is now more convenient, efficient, and safer.

Below you can find some of the existing and newer players in the AI landscape.

AI in finance is amongst the few technologies that are paying dividends. Artificial Intelligence has transformed the banking and finance industry and has made it more demand-specific. Accessing, spending, and saving money is now more convenient, efficient, and safer.

Below you can find some of the existing and newer players in the AI landscape.

80% of banks are aware of the potential benefits that AI presents. Artificial intelligence can be adopted by banks to offer customers continuous access to their accounts and financial advisory services. This will not only improve customer experience, it will also streamline tedious processes. Overall, banks can save approximately $447 billion by 2023 if they adopt AI applications.

Here’s a quick look at how Goldman Sachs, one of the biggest banks in the world, has been using AI.

Artificial intelligence has the potential to transform the Finance and Accounting industries. With advancements that eliminate tedious tasks, AI leaves professionals free to do more lucrative analyses and counseling for their clients. Yet, organizations hesitate to employ AI in their workforce due to uncertainties around business cases or the ROI.

Some of the benefits and risks of using AI in this industry are:

Artificial intelligence has the potential to transform the Finance and Accounting industries. With advancements that eliminate tedious tasks, AI leaves professionals free to do more lucrative analyses and counseling for their clients. Yet, organizations hesitate to employ AI in their workforce due to uncertainties around business cases or the ROI.

Some of the benefits and risks of using AI in this industry are:

|

Benefits |

Risks |

|

1. Reduced errors

Through ML algorithms, companies can analyze more data and identify any hoax activity. Companies can search through huge chunks of data from different sources and report any errors through a visual tool. For example, Xero recorded 90% more accurate results while analyzing 50 invoices after adopting AI.

2. Shorter decision-making periods

Firms can now process huge chunks of data within weeks instead of months. AI can process large complex chunks of data quickly.

3. Make accounting tasks easier.

AI machines automate accounting procedures, ensuring efficiency and cost reduction.

4. Savings from the replacement of human capital

AI can be used to do the monotonous job of extracting, organizing, and structuring the data. This saves time, eliminates errors, and reduces liability. |

1. Loss of jobs:

Since software replaces human capital, many professionals can and will lose their jobs. From 2004-2014, the number of full-time employees decreased by 40% due to the introduction of AI, as reported in the Wall Street Journal.

2. Implementation cost

The adoption of AI involves revamping the entire system, which is time-consuming and very expensive, both in terms of software and labor training.

3. Subject to learned bias and prejudice

For AI algorithms to learn effectively, they need access to existing malware codes, requiring tremendous financial and operational investments. Moreover, human biases and errors unintentionally develop in the technology itself.

4. Data Security

Cybercriminals use AI to get around AI defenses. In 2018 alone, attackers were present in the system for 177 days before they were caught.

|

The role of a CFO is crucial in defining the path of a company’s future. With insights into all business units of the company and how they interact with each other, the CFO can help the organization make smarter business decisions.

The advent of AI in Finance & Accounting has propelled CFOs to rethink the function of finance. According to a 2019 PWC Report, 61% of finance leaders believe that finance functions could become more effective with improved technology. As a result, the CFO has to have a solid foundation and understanding of data, the underlying “tech stack” of the business, and how to derive insights from the various “sources of truth”.

Moreover, the talent gap is substantial. Finance teams need to increase their level of sophistication in understanding data manipulation and analytics to provide more “value-added” analysis to their partner business units at large enterprises.

Maintaining an edge in Finance & Accounting heavily relies on the use of the latest tools and software. Automation promotes fluidity of processes and helps to mitigate, and even eliminate, the current silos between the different activities of financial departments. AI tools help in eliminating tedious tasks, empowering CFOs to make quicker and better business decisions.

AI makes it possible for data analysts and business leaders to make sense of their company’s data. Through numerous data analytics tools, CFOs can generate meaningful insights about what is going on with their Finance & Accounting. These technologies allow them to focus on data, gain more knowledge about their company, and make smarter decisions.

CFOs can leverage machine learning tools to conduct accurate modeling of the future. This type of modeling is far more powerful and relevant than the traditional methods of projecting. When using AI tools, CFOs would follow a path starting with descriptive analytics and proceeding through more accurate diagnostic, predictive, and prescriptive analytics. This would allow them to become a source of business intelligence in the organization.

CFOs will have to develop and maintain a strong understanding of the capabilities of current automated tools and those under consideration, then ensure that their staff has the skills that are not yet replicated by machines. They also must have the capacity to accept when it’s time for certain executive-level tasks they handled in the past to move to an automated process.

A study conducted by the Boston Consulting Group (BCG) and MIT Sloan School of Management showed that 85% of the professionals understood the importance and advantages of adopting AI. Despite this, the only barrier to the adoption of AI in Finance and Accounting firms is the low acceptance rates of AI by the employees. A shift in mindset is required from the accounting professionals to accept the changes. Through AI-enabled systems, accountants are freed up to build relationships with their clients and deliver critical insights.

To help accountants accept and embrace the new technology, the benefits of AI must be explained to the employees through training and support. For example, professionals need to learn programming languages, such as R or Python for statistical analysis, SQL for data queries, and Spark for big data analytics.

Similarly, accounting students need to be exposed to artificial intelligence. Universities teaching Finance and Accounting should integrate AI and ML into the curriculum to train students before entering the job market.

Upskilling is the fastest way to reduce the widening skills gap between professionals and fresh graduates. Basic digital literacy will help employees ensure data privacy and help them use the right digital channels for communication. Technology know-how will further add value to the organization.

The future of financial services lies in its ability to benefit from new technologies fully. Companies can start by making short-term investments in AI and make appropriate investments for the use of AI in the long run. Another way to help employees adapt to AI is through strategic collaborations. Open forms can be used to solve issues collectively and share learning responsibility. Accounting firms can also work with policymakers to explore the segments where AI can be applied.

Those in the Finance and Accounting industry must know how to operate in a digital environment. The mindset is a fusion of the ability to confront complexity, work in an agile and creative manner, and harness curiosity to learn further. Accountants that resist these changes will not be able to keep up with those who have the advantage of time, cost savings and insights that AI can provide.

The future of financial services lies in its ability to benefit from new technologies fully. Companies can start by making short-term investments in AI and make appropriate investments for the use of AI in the long run. Strategic collaborations, like open forms that can be used to solve issues collectively and share learning responsibility, can help companies adapt to AI. Additionally, accounting firms could work with policymakers to explore segments where AI can be applied.

Those in the Finance and Accounting industry must know how to operate in a digital environment. The mindset is a fusion of the ability to confront complexity, work in an agile and creative manner, and harness curiosity to learn further. Accountants that resist these changes will not be able to keep up with those who have the advantage of time, cost savings and insights that AI can provide.

AI has, and will continue to impact Finance & Accounting, in multiple ways:

Companies have started to be a lot more agile and responsive when it comes to solving problems related to finance, corporate development, and decision making. Despite this rapid pace of advancement, there is hardly ever a problem that technology alone can solve. Thus, there is no need for mass hysteria surrounding the application of AI in Finance & Accounting. What is needed is a combination of people, processes, and technology.

At Trivium Global, we believe in a people-led future, fueled by technology – and not vice versa.

Get in touch with us to know more about how we can help you navigate through these challenges.